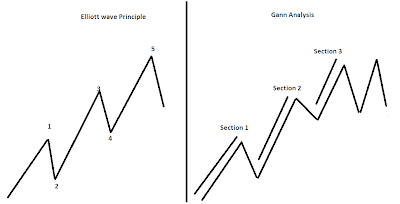

Difference between Elliott Wave and Gann Analysis

Elliott wave

Principle and Gann analysis both are different and unique. Thus both technical

theories work very well in today’s market. Here we will not see the practical

application of the theories but the difference between them

1. Elliott

Wave Principle says that in an impulsive wave there should be 5 waves in which

3 waves decide the market direction and 2 waves are just the reaction. Whereas

Gann analysis says that in order to know the trend of the market on the upside

there should always be 3 section more than 3 section can be utilized as an

opportunity to create short positions.

From the above chart

we can come to a conclusion that more than 3 section will suggests that the

trend of the market is not going to sustain and there are high chances for the

market to reverse. This is one of way to catch a top or the bottom.

Comments