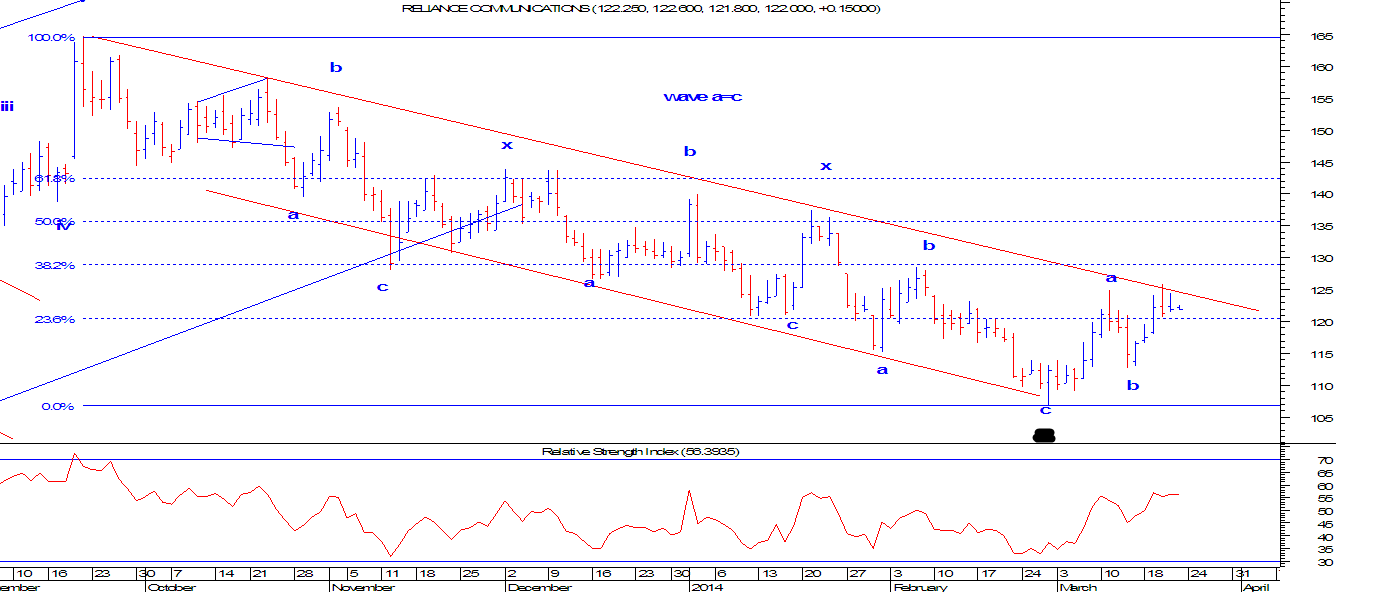

Reliance Communications: Near Completion of Channelized Move and Elliott Wave Counts.

Telecom is one of the

underperformer sector as compared to other sectors such as Banks, realty, MNC’s

etc. This means the entire telecom pack which includes Bharti Airtel, Rel Com,

Idea, Tata Com has not performed in sync with Nifty.

We are going to

discuss on Reliance communication as this stock has failed to show any positive

momentum from past 6 months. It is not acceptable for this high beta stock to

underperform even when Nifty moved up almost 1300 points on the upside in last

6 months.

By applying the

combination of basic technical analysis and Elliott wave theory it becomes easy

to forecast the upcoming trend for a particular asset class. Simple technicals

like channels, retracements etc help us to know the possible support and

resistance for the asset class.

From the below daily

chart of Reliance communication, we can see clearly that prices are moving down

after making a high of 164.65 on 20th November 2013. Thereafter it

failed to move above its high and started moving down by breaching its previous

lows which opens negative possibilities. We can also observe that the stock was

precisely moving in a down ward sloping red channel from past 6 months.

Recently in the month

of March 2014, prices failed to move below its previous low and crossed its

previous pivot high which opens positive possibilities. Today prices have also

given a bullish break in a falling red channel which is a healthy sign. Prices

can outperform in next series or so.

As per wave

perspective……………………………………………………………………………………………………………………..

In short, our bias

for Reliance Communication is ……………….as it can move till …over short term.

Subscribe to our

research report to know what is next in Reliance communication by subscribing

to our research report “The Equity Waves”

which is a daily publication and covers Nifty and 3 stocks on rotational

basis. For subscribing write to us at fivearcadvisory@gmail.com

Comments