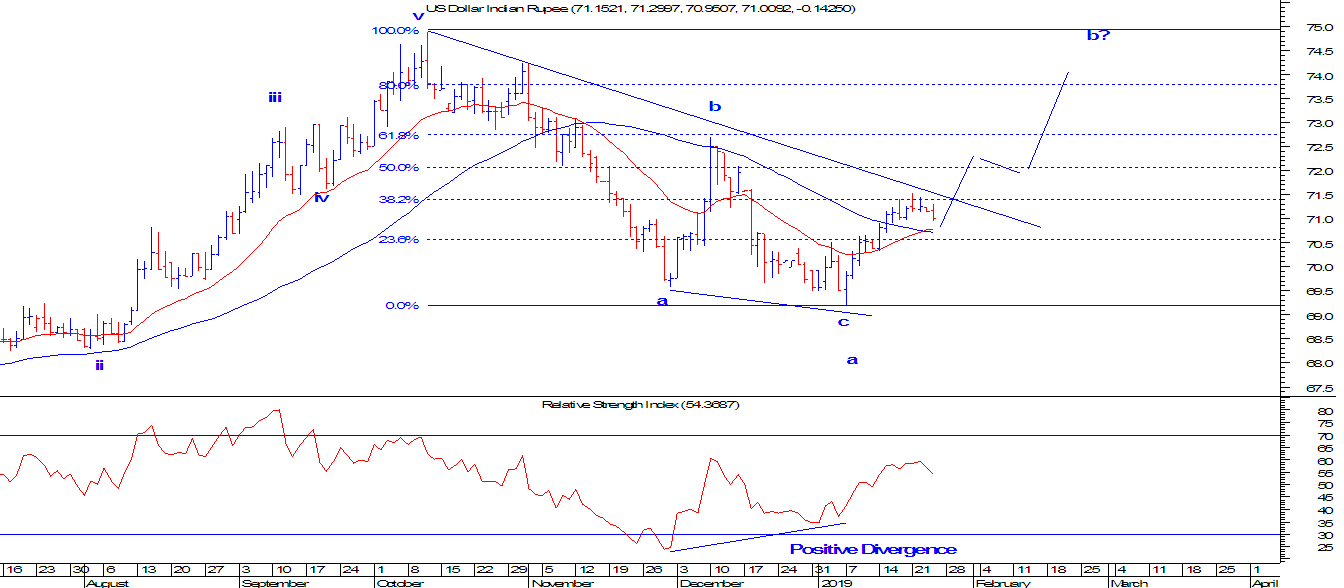

USDINR: Expected to surge

USDINR Daily Continuous chart USDINR is currently hovering near the resistance of the falling trend line. However, the short term moving averages have given a bullish crossover after two months from its previous crossover. It is important for prices to move above 71.50 levels for further positive possibilities which can push prices higher. Any sustainable move above 71.5 will make price surge near till 80% of the previous fall which is placed at 73.6 levels. RSI has exhibited positive divergence. Wave theory suggests that, prices might have completed wave a in three wave structure (a-b-c) at 69.2 and is now moving higher in wave b which can be close to the above mentioned level. In short, USDINR will surge till 73.6 levels over short to medium term once the level of 71.5 is taken out decisively. After 71.5 is crossed the support will be placed at 70.90 level. Learn Elliott Wave and Neo Wave to forecast prices in various asset classes. Subscribe to a two day paid on...