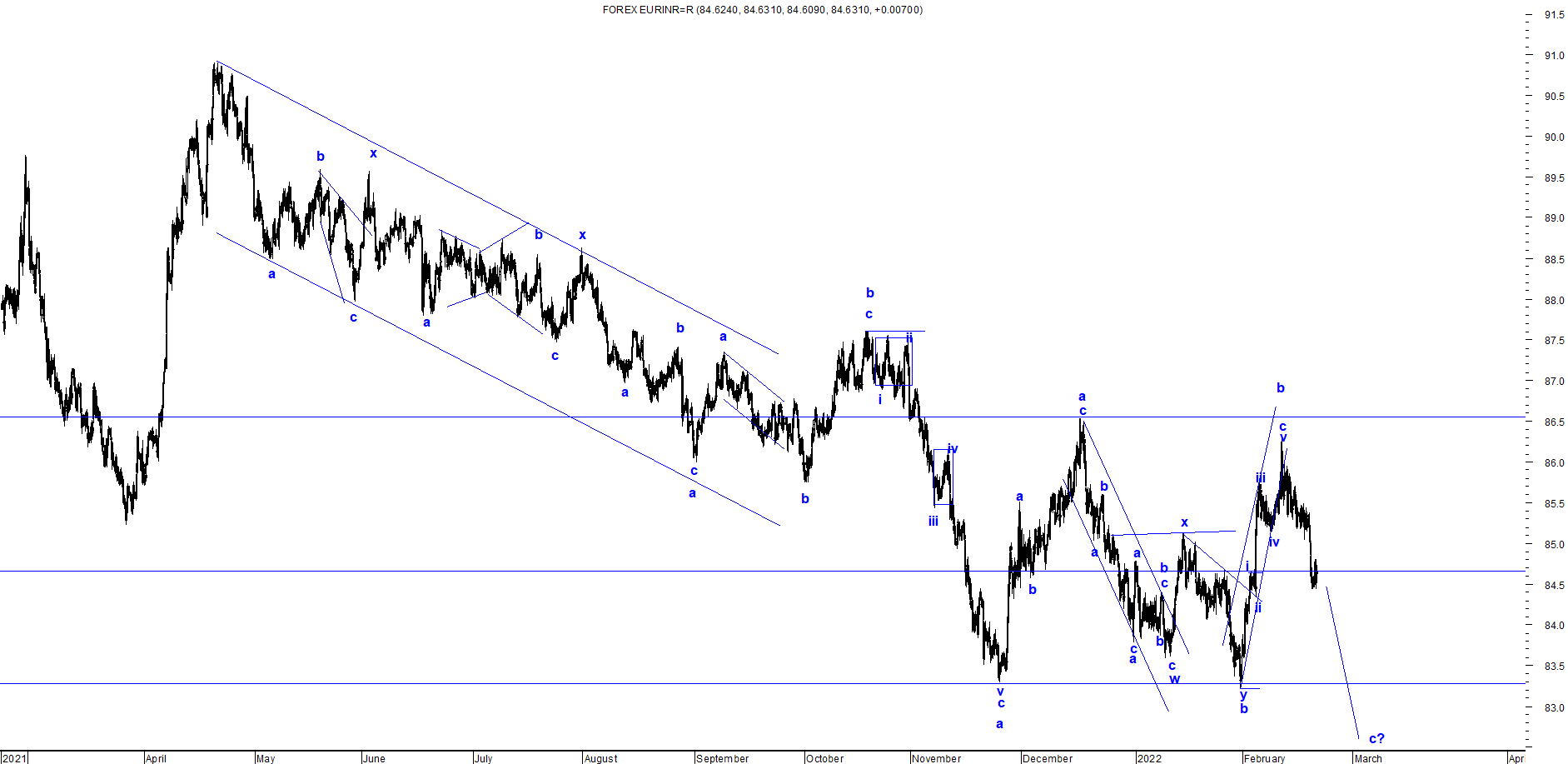

EURINR: Elliott Wave Analysis

EURINR 60 min spot chart

EURINR is moving in a lower highs and lower lows which opens negative possibilities. Recently it tested the level 86.5 (spot) and thereby moving down in a stealth downtrend. The pair is negatively poised and it is set to move down from current levels.

As per Waves perspective, prices are moving in corrective wave where it completed wave a in complex correction, wave b in regular flat pattern and wave c has just opened up. This wave c can drag prices near till 81 levels over short term.

The summation is EURINR is negatively poised and can test the level of 81 over short term.

Comments