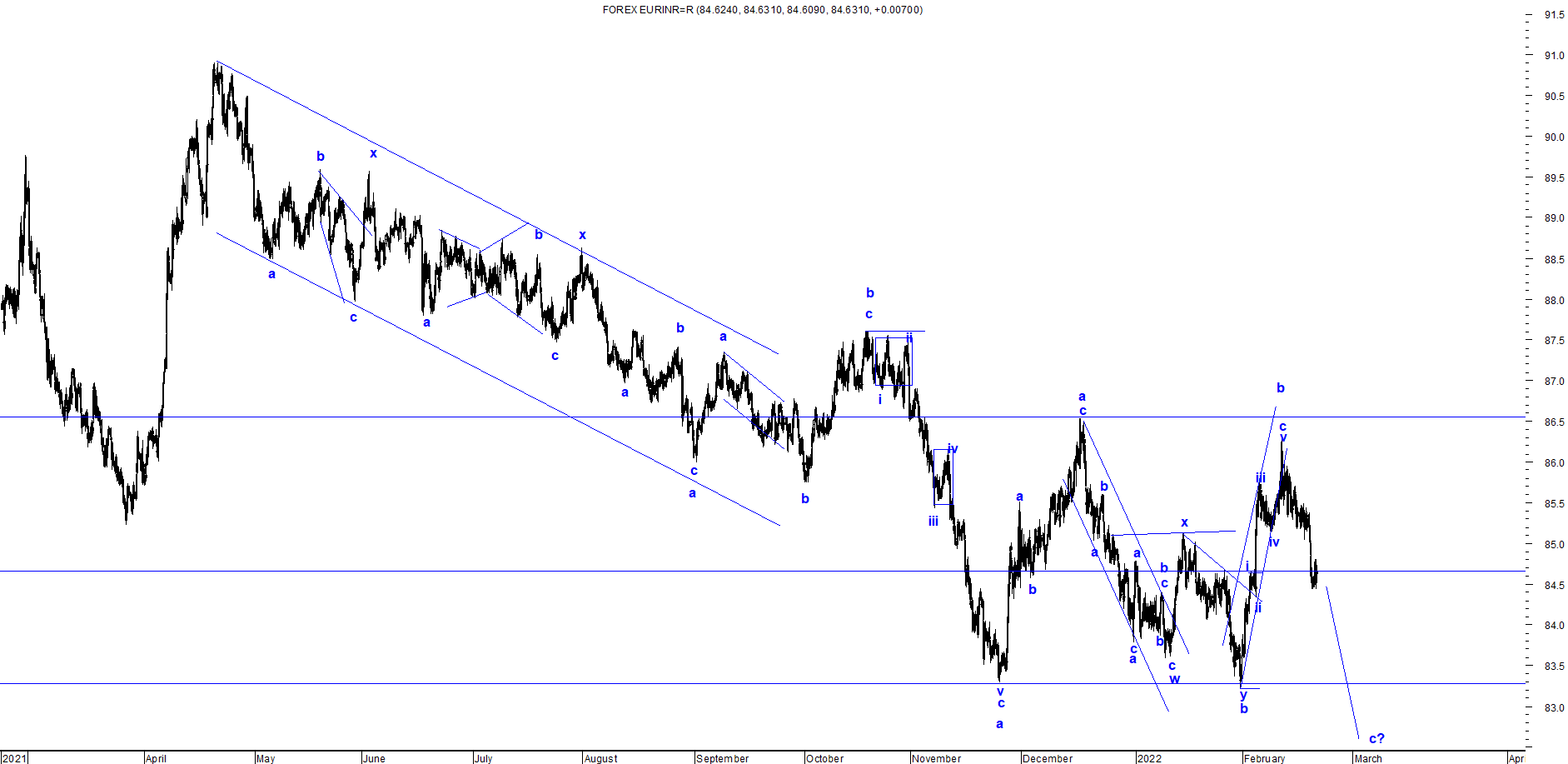

EURINR: Possibility of Reversal with Elliott Wave Analysis

EURINR spot 60 mins chart anticipated on 21st Feb 2022

EURINR spot 60 mins chart happened 7th Mar 2022

From my previous update in EURINR, I had mentioned that, "EURINR is negatively poised and can test the level of 81 over short term."

Prices faltered till 83.5 and is showing signs of reversal which indicates that it wont sink further but will move up. I have made a serious attempt for the pair to tumble which it did to a certain extent.

To view my previous article on EURINR, click on the below mentioned link

https://www.marketanalysiswithmeghmody.com/2022/02/eurinr-elliott-wave-analysis_21.html

As per wave analysis, I think prices have completed wave a at one higher degree and now wave b has started which can go up from current levels.

The summation is EURINR is all set to reverse and can reach a level of 85-85.3 levels over short term.

Comments