Tata Chemicals: Elliott Wave Analysis

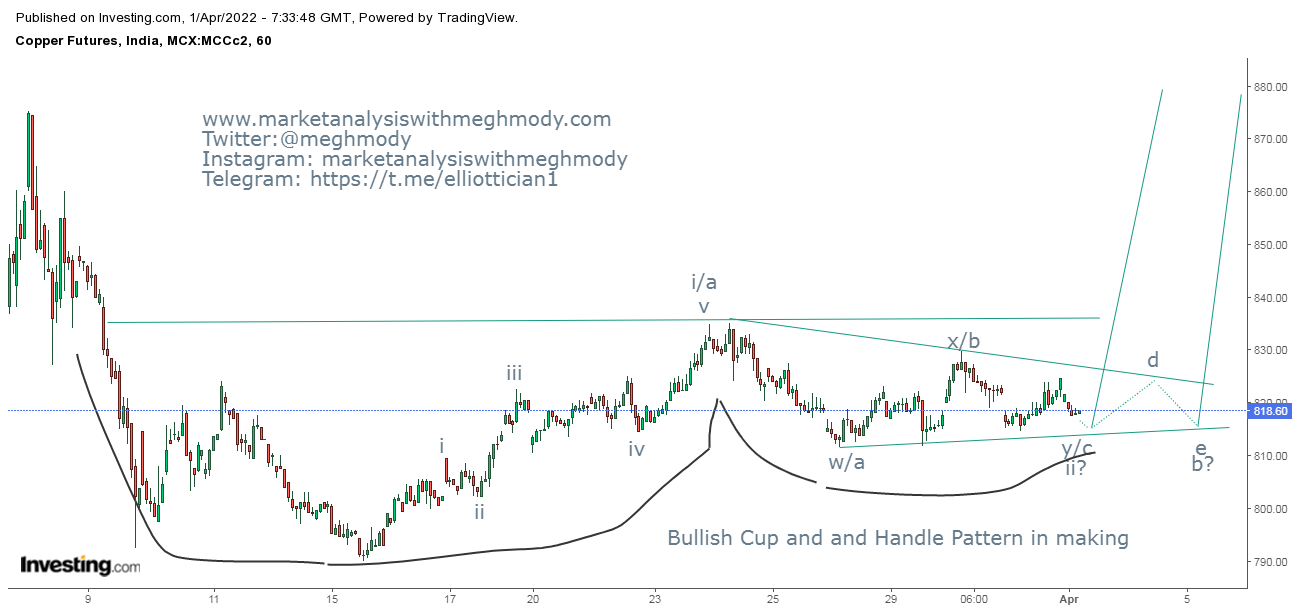

Tata Chemicals 60 mins chart The above chart makes us understand that the trend is down as it is forming a lower highs and lower lows and moving precisely in a falling channel. Currently it is hovering near the resistance of the channel and soo there can be a reversal which can drag prices way lower. As per Elliott Wave, prices are moving in a corrective pattern (a-b-c) where wave a was a complex pattern and wave b was easier to identify and wave c is unfolding. This wave can lead prices to the level of 780-760 levels. The summation is Tata Chemicals is negatively poised and can falter till 780-760 levels over short to medium term.