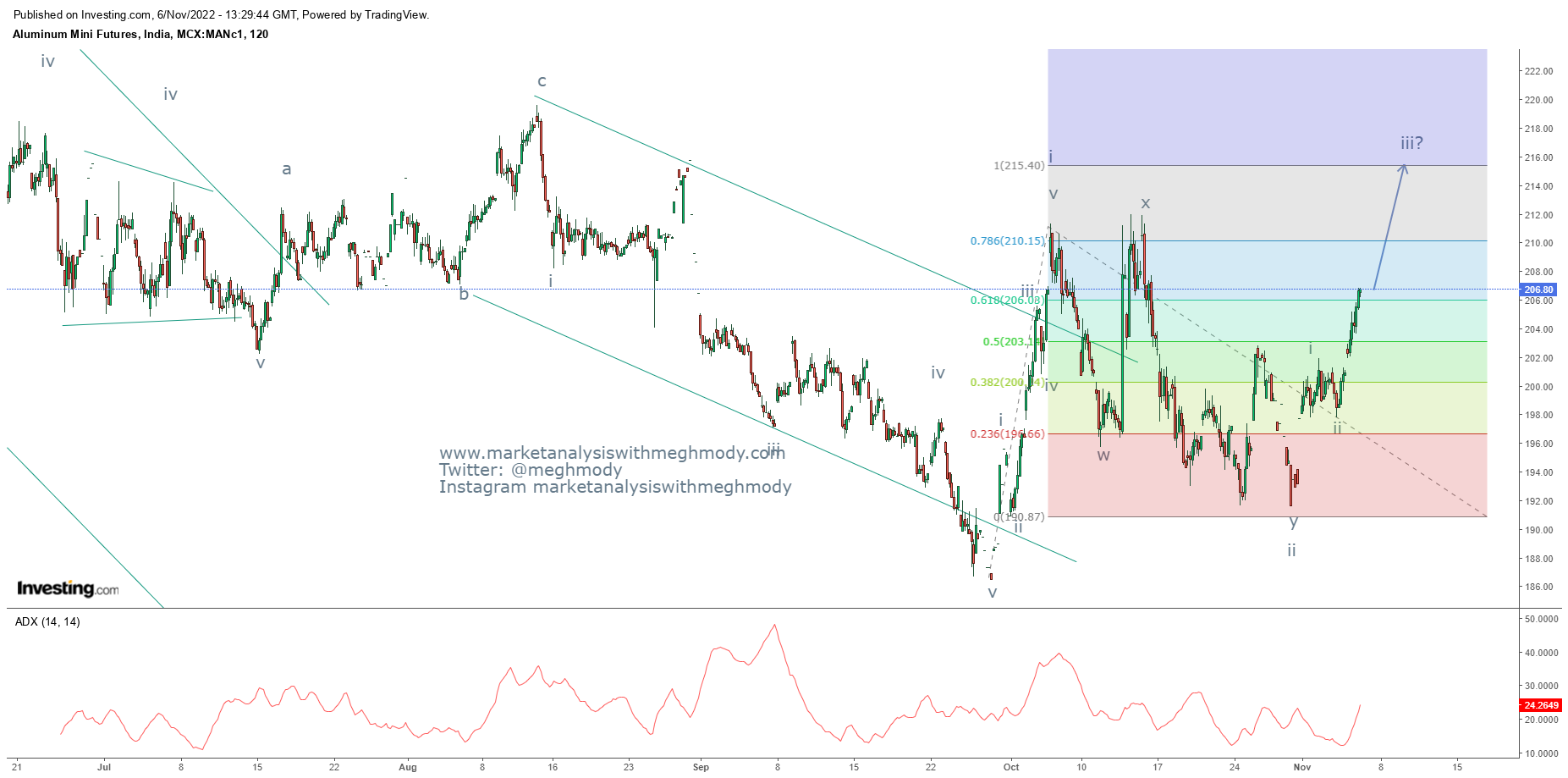

MCX Aluminum and the road ahead

MCX Aluminum 2 hour continuous chart anticipated on 6th November 2022

MCX Aluminum 2 hour continuous chart happened on 2nd

December 2022

Analysis

In my previous

update on MCX Aluminum I had mentioned that, “MCX Aluminum is positively poised

and can move till 215-220 range over short term with support placed at 198

(closing basis).

The base metal

reached my resistance zone of 215-220 levels by marking a high of 216 levels – Anticipated

Happened.

To view my previous article on MCX Aluminum, click on the below link

https://www.marketanalysiswithmeghmody.com/2022/11/mcx-aluminum-revisited-and-elliott-wave.html

From the above

chart, MCX Aluminum continues to transcend its previous high thereby giving a

positive sign. The metal is expected to move towards its next resistance placed

at 224 levels over short term. However, RSI is in overbought terrain.

As per wave theory,

prices are moving in wave iii which is extended in which wave i is expanding

leading diagonal followed by wave ii lower and then it has started wave iii of

wave iii which can go till 224 levels

The summation

is MCX Aluminum is positively poised and can move towards 224 levels over short

term. Any move below 204 will negate the upside move.

Comments