Nifty: Ending Diagonal Pattern

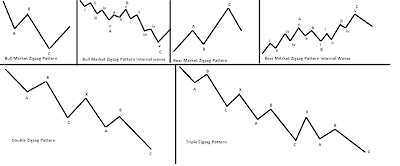

Ending Diagonal pattern popularly known as Wedge is always difficult to identify especially in making. Normally in wedge pattern we can see that prices are making higher highs and higher lows but the momentum on the upside slows down. In relation to this we can also compare it with Relative Strength Index (RSI) where it will form lower highs and lower lows which will give a negative divergence. Such divergence will give an indication that upside is capped and there are high chances for market to reverse. We will explain further on ending diagonal pattern but before that we will show where ending diagonal has occurred and how it has impacted the markets. The wedge pattern has occurred before the fall of 2008, before the fall of 2013 and the recent fall of 2014 where it eradicated more than 300 points. This wedge pattern has occurred on smaller time frame. Ending Diagonal Pattern is one of the pattern which occurs in wave 5 or in wave C. It is drawn with the help of two trend...