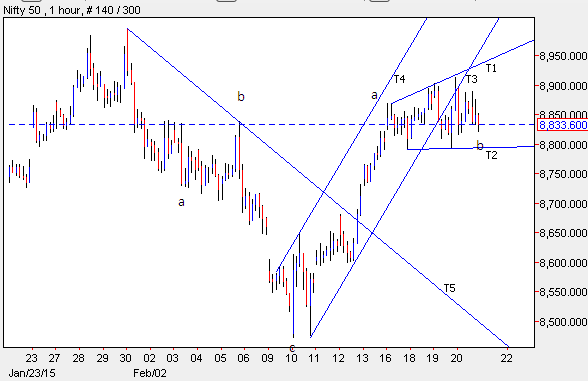

Nifty to climb 9200-9300 levels?

Nifty has corrected by almost 4.5% from its all time high of 9119 levels. The recent down move seems to have lost momentum and it seems that the major trend for the index which is undoubtedly positive will resume. Majority of the indicators are in oversold zone and it is difficult now to say what will be the next move from viewing the indicators. In the advance version of Elliott wave theory i.e Neo wave Prices are moving in a diametric pattern. Here in this case it is Bow and Tie Diametric Pattern. It has seven legs in it (a-b-c-d-e-f-g). All the legs in this pattern are corrective in nature. Currently it is moving in a wave f and it is on the brink to complete this leg on downside, thus opening the possibilities for the next leg on upside which will be wave g. This wave g will move above its previous high. In Nifty the previous high is 9119 levels, so if wave g has to cross its previous high which wave e it will surpass 9119 levels and can possibly move up till 9200-9300 le...