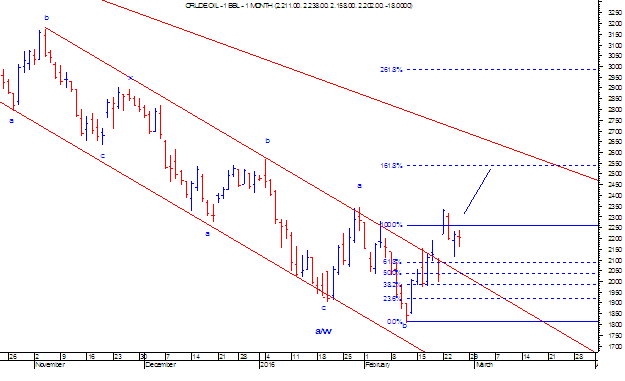

MCX Natural Gas: Diametric formation underway

In my previous update " MCX Natural Gas to halt its rally " dated 12th January 2016, I had mentioned that " Break of rising channel opens bearish possibilities, as the support of the channel is at 159, Nat Gas is expected to shed gains. Currently prices are quoting at 155 levels . The counter wave will be a three wave structure (a-b-c) and can move in a range of 146-150 levels. In short, expect prices to fall till 146 levels going ahead." Nat Gas moved lower near till 138 in the month of January 2016 thus achieving our mentioned level of 146. Later it faltered till 120 levels in late February 2016. Prices are moving above the declining red channel and it is possibly consolidating above it. The bias which was also mentioned earlier is positive but will face counter rally, looks to stay for sometime. As per Neo wave, prices are forming a diametric pattern, in which it has possibly completed wave e and will move up near till 140 levels to complete wave f,...