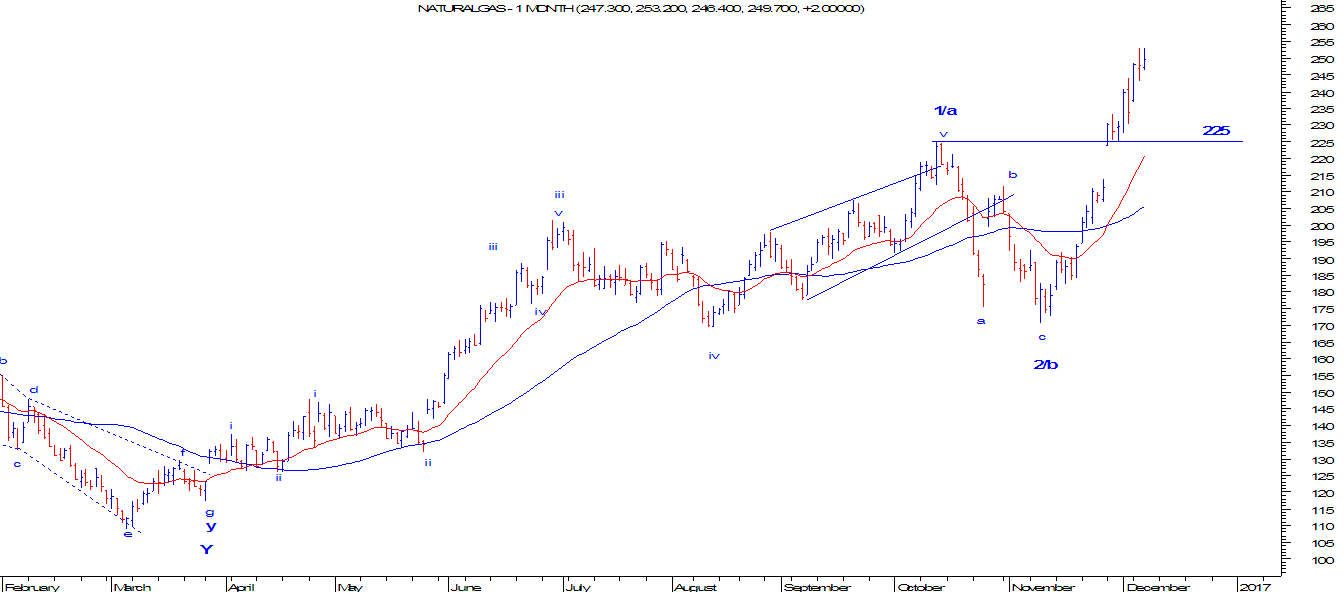

MCX Natural Gas: Neo wave Analysis

NG Daily Continuous chart From the above daily continuous chart of Nat Gas, it is clearly visible that prices broke the lower band of a sideways pattern. NG which was moving in a consolidation pattern of 200-185, has finally come out of it by breaking the support of 185, thus opening negative possibilities. As per Neo Wave analysis, after forming a top of 264 in the year 2016, prices moved in a three wave structure down, Where the first wave was a three wave structure, second wave was a five, forming an extracting triangle and the last will be the impluse wave which can drag prices further lower. In short, the bias for NG remains firmly negative as prices will moved down till ..... odd levels in near term. Learn Elliott Wave and Neo Wave in a two day seminar, so that you can get the desired calculation of the above asset class. For more details mail me meghmody@gmail.com