Bank Nifty (Elliott Wave Analysis)

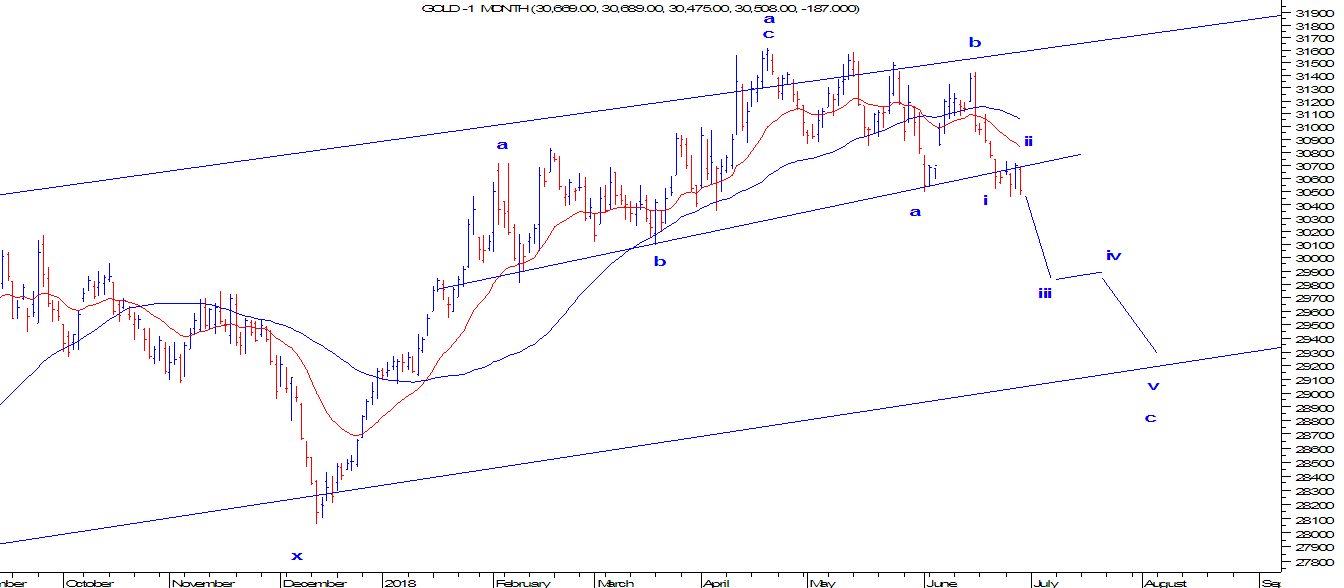

Daily Chart of Bank Nifty From the above chart of Bank Nifty, it is visible that prices are moving precisely in a rising channel by forming a higher highs and higher lows which is a positive formation. As far as prices persist in this channel, the bias will remain positive. Technical indicator RSI as shown in the chart has relieved from the overbought zone and can resume the uptrend soon. As per Wave perspective, the channelized move is an impulse wave, in which wave iii is either ongoing or it is over. It can also be extended or can be an extension within extension. However it is early to jump to the conclusion. This means wave iv and wave v is still pending. In short, the bias is positive and prices can test 29000 or above that in near to medium term with the crucial support of 27500.